With its enterprise hardware and software sales both under pressure right now, Cisco Systems (CSCO) guided for its revenue to drop sharply again this quarter.

After the bell on Wednesday, Cisco reported July quarter (fiscal fourth quarter) revenue of $12.15 billion (down 9% annually) and non-GAAP EPS of $0.80 (down 4%), topping consensus analyst estimates of $12.09 billion and $0.74.

But the company also guided for a 9% to 11% annual October quarter revenue drop, and for EPS of $0.69-$0.71 (down 15% to 18%). Those guidance ranges are below consensus estimates for a 7% revenue drop and EPS of $0.75.

Also: On Cisco’s earnings call, CEO Chuck Robbins disclosed that Kelly Kramer, who has been CFO since 2015, will be retiring once a successor is in place.

As of the time of this article, Cisco’s stock is down 6.3% in after-hours trading to $45.05. Rival Juniper Networks is down 1.1% and chip supplier Marvell Technology (MRVL) is down 1.4%.

Here are some notable takeaways from Cisco’s earnings report and call.

1. Cisco Is Planning Job Cuts

“Over the next few quarters, we will be taking out over $1 billion on an annualized basis to reduce our cost structure,” said Robbins on the call. Kramer later added that about 80% of the spending cuts will involve operating expenses, and said after the call that the cuts will start with a voluntary retirement program.

For context, Cisco’s GAAP operating expenses totaled about $17.4 billion in just-ended fiscal 2020, after backing out restructuring charges and amortization expenses for purchased intangible assets.

2. Corporate Hardware Spending Remains Pretty Weak

Cisco’s Infrastructure Platforms product sales — they cover Cisco’s core hardware businesses plus sales of related software — fell 16% annually to $6.63 billion. Kramer noted switching, routing, wireless (Wi-Fi) and “data center” (server/storage) product sales all fell, while adding data center revenue was particularly weak due to both soft demand and lower DRAM prices (passed on to customers).

Robbins indicated that Cisco saw healthy demand among the largest enterprises and with federal clients, but added (in line with what various other enterprise IT firms have shared) that demand was weaker among smaller businesses, and that headwinds are particularly large in the Americas.

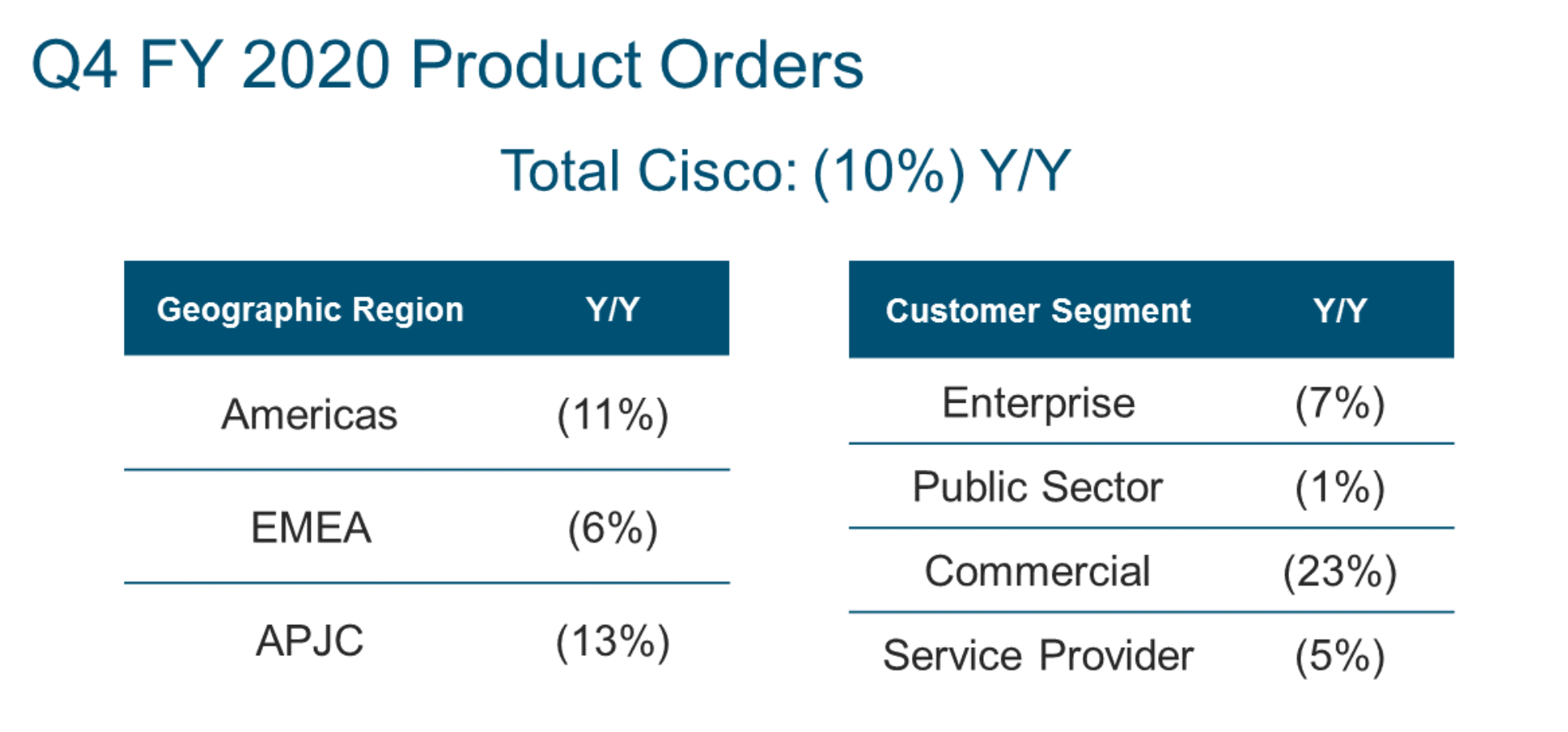

These pressures contributed heavily to a 10% annual drop in Cisco’s total product orders (worse than the April quarter’s 5%). Enterprise orders fell 7%, while “Commercial” orders (they involve SMBs and midmarket firms) fell 23%.

3. Software and Service Provider Trends Are Mixed

Cisco’s Applications segment revenue — it covers various software businesses, as well as its collaboration hardware sales — fell 9% to $1.36 billion.

The Webex conferencing software business saw double-digit growth — Zoom (ZM) , it should be noted, saw 169% revenue growth in its April quarter — and the AppDynamics app performance monitoring software unit was also said to have done well. But this was offset by weaker demand for unified communications software (RingCentral (RNG) has been gaining share here) and telepresence endpoint devices.

With COVID-19 perhaps accelerating a long-term trend, the percentage of software revenue involving subscriptions rose to 78% from the April quarter’s 74%. Subscription software orders helped Cisco’s remaining performance obligation (RPO – it covers all revenue that it has under contract but hasn’t recognized) grow 12% annually to $28.4 billion, with product RPO rising 17% to $11.3 billion.

Service Provider orders, a large portion of which involve routers, were down 5% annually. Robbins indicated service provider sales grew in Asia and Europe, and (though down more in Canada and Mexico) were just slightly negative in the U.S.. He also said Cisco has seen “some traction” with its efforts to sell heavy-spending cloud giants on its 8000 Series routers and Silicon One processors, but cautioned these efforts aren’t “meaningfully moving the numbers yet.”

Cisco’s July quarter product orders. Source: Cisco.

4. Security and Services Were Bright Spots

Security product sales rose 10% to $814 million. Kramer indicated a number of products contributed to this growth, while adding that Cisco’s cloud security offerings saw “strong double-digit growth,” aided by its Duo user authentication platform and Umbrella cloud network security platform. Robbins said that Cisco has more than 2,100 daily active customers for its end-to-end SecureX platform, which launched six weeks ago.

Service revenue — a large portion of which involves maintenance/support services for deployed Cisco products, and is thus fairly stable — rose fractionally to $3.32 billion. Services RPO rose 9% to $17.1 billion.

5. Cisco Seems Open to Being More Aggressive with M&A

On the call, Robbins, whose company has made many acquisitions since he became CEO in 2015, suggested Cisco could be willing to pay steeper valuations for acquisitions than it traditionally has in order to obtain valuable technology assets.

“I think that there’s clearly a recognition that the valuations of the assets that are attractive have achieved different levels, and so I think that we’ll continue to be disciplined. But I would say that we’re open to looking at the current world and the reality that we live in,” he said, while adding that Cisco maintains “a list of potential targets.”

6. No Stock Buybacks Took Place

For the first time in a while, Cisco went through a quarter without repurchasing any stock. The company had spent $1.5 billion during its April quarter to repurchase 25 million shares.

With Cisco possessing more than $14 billion in net cash as of July 25 and still generating large amounts of free cash flow, the company would have no trouble footing the bill for additional buybacks if it wishes.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.